Exponential Industry

“A factory deserves more innovation and more engineering skill than the product itself.”

Elon Musk

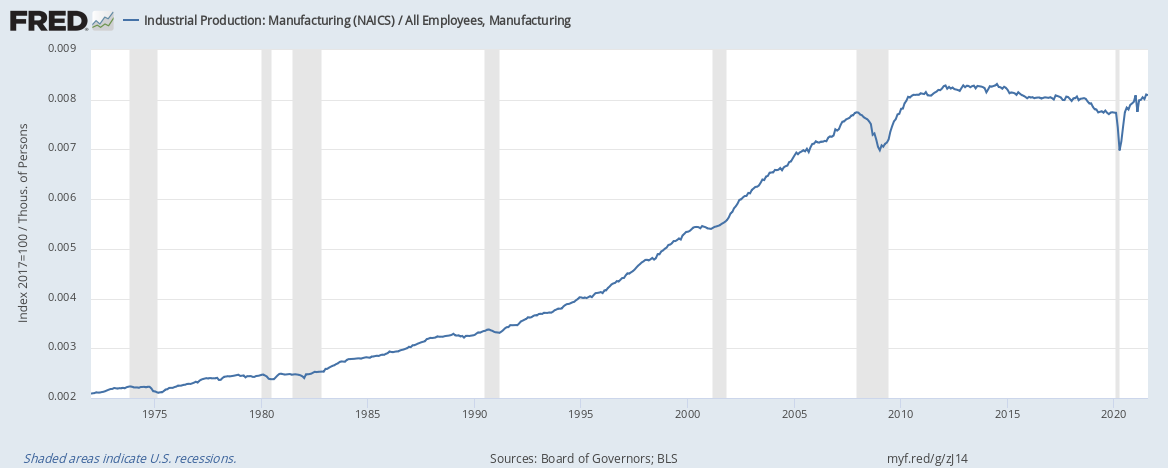

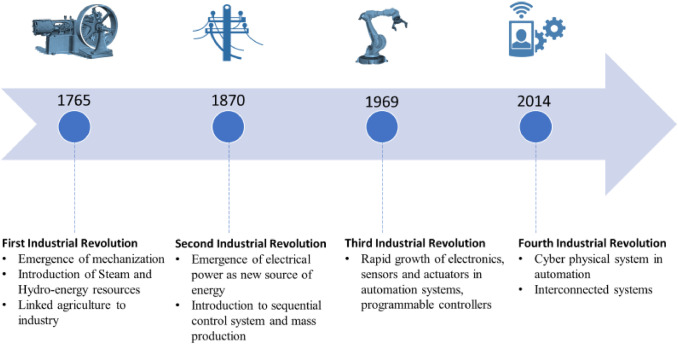

For most of the last 50 years, US manufacturing productivity, the increase of production of goods with relatively fewer inputs, has increased at an exponential rate. The chart above shows this phenomenon throughout the 1970s, 1980s, 1990s, and early 2000s. This period is commonly referred to as the Third Industrial Revolution and was marked by the adoption of transformative technologies such as general purpose computers, microelectronics (PLCs, microcontrollers, etc.), telecommunications, and robotics bringing high-level automation to industry. Following the Global Financial Crisis in 2010, manufacturing productivity has leveled off. The Bureau of Labor Statistics and many others have studied this great stagnation in comprehensive detail. The way forward is uncertain, but there is hope that emerging manufacturing technologies will return us to these exponential productivity gains that go back to the First Industrial Revolution starting in the late 1700s.

The Exponential Industry blog and newsletter covers the next wave of innovation of smart manufacturing and supply chains as part of the Fourth Industrial Revolution or Industry 4.0. The Industry 4.0 trend of automation and data exchange in manufacturing technologies is well underway but many questions of what is possible still persist. This blog seeks to build community across engineers, managers, and observers innovating within industry through weekly coverage of the latest in Industrial Internet of Things (IIoT), machine learning (ML) and artificial intelligence (AI), 3D printing, cyber-physical systems, virtual reality (VR), augmented reality (AR), robotics, and more!